White paper "Data Architectures to power modular banking"

Unlocking modular banking: 3 essential steps for CIOs

In this white paper, we show which technological and organizational approaches banks can use to create agile and efficient structures and processes in order to access data flexibly and utilize it for new use cases.

Why technology leaders should read this white paper

Digital transformation in banking is reaching a tipping point–and data is the key driver. This white paper is designed for technology decision-makers and innovation leads who understand that without a flexible, data-driven architecture, real progress is impossible.

Here’s what makes this white paper essential:

- Real-world solutions: No vague visions. Learn how banks can implement modern integration technologies, configurable interfaces, and collaborative data platforms to unlock agility and innovation.

- Customer-centricity through data: See how to power personalized customer journeys and real-time offers using existing bank data—efficiently and securely.

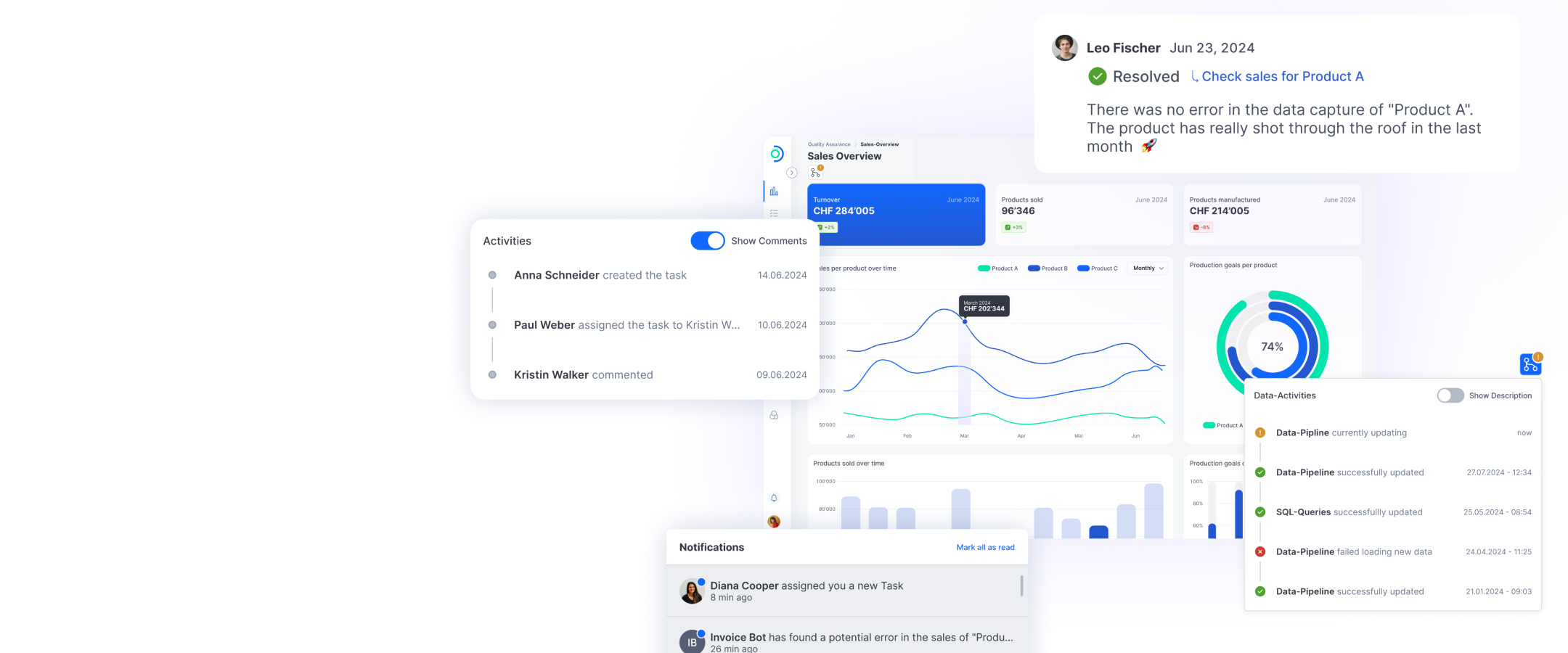

- Smarter collaboration: Explore how modern BI platforms enable teams across departments to work together dynamically on data-driven initiatives—all within one integrated environment.

- Strategic data organization: Understand the importance of a Data and Analytics organization that embeds roles, responsibilities, and governance to break silos and scale innovation.

If you’re ready to stop managing complexity and start using data strategically, this white paper provides the blueprint you’ve been looking for. Download it now and uncover the data potential already at your fingertips.

Download now our free white paper “Data Architectures to power modular banking”.

Key takeaways from the white paper

#1

Decouple core systems to unlock flexibility

#2

Enable collaboration through business intelligence platforms

#3

Transform into a data and analytics organization

#4

Bridge the gap between business and IT

Find out more about our banking products and solutions

Head of Banking Strategy & Senior Advisor

Daniel Ott

Would you like to discuss with us the technological and organizational approaches that your bank can use to use data efficiently and intelligently?